Business

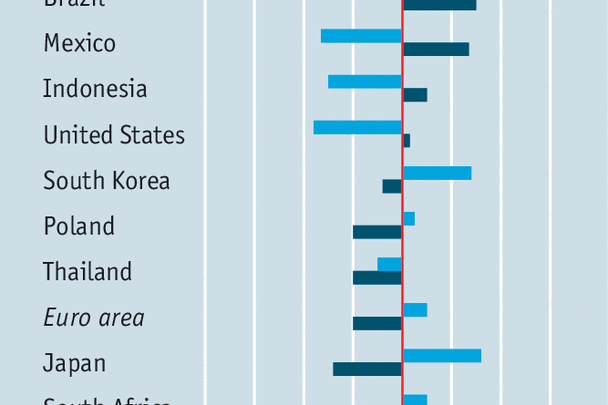

Dear oil helps some emerging economies and harms others

When they are not fretting about the American dollar or Chinese debt, policymakers in emerging economies keep a close eye on the oil market. The price of Brent crude has risen by nearly 50% in the past year to around $80 a barrel. It ranks as the 11th-biggest spike in the past 70 years (adjusted for inflation), according to UBS, a bank. So should emerging markets now worry that oil prices will carry on rising above $100, or that they will tumble below $50? The answer is yes.

Many emerging economies import oil; others export it. As a rule, higher prices hurt the first group and lower ones hurt the second. But it can be more complicated than that. Indonesia, for example, is a net importer of oil, but a net exporter of “energy”, more broadly defined, including coal and palm oil. Since coal, palm and oil prices tend to rise roughly in tandem, Indonesia would benefit overall from $100 oil, according to UBS. Mexico, like America, is also a net importer of crude. But in both countries a higher oil price…Continue reading