Business

Markets may be underpricing climate-related risk

AS A citizen, Dave Jones worries that climate change may imperil his two children, and theirs in turn. What exercises him, as California’s insurance commissioner, is the way in which a transition to a low-carbon economy might affect the financial health of his other charges—the state’s 1,300-odd insurers. On May 8th Mr Jones unveiled an examination of how well the investment portfolios of the 672 insurers with $100m or more in annual premiums align with the Paris climate agreement of 2015, in which world leaders vowed to keep global warming below 2°C relative to pre-industrial times.

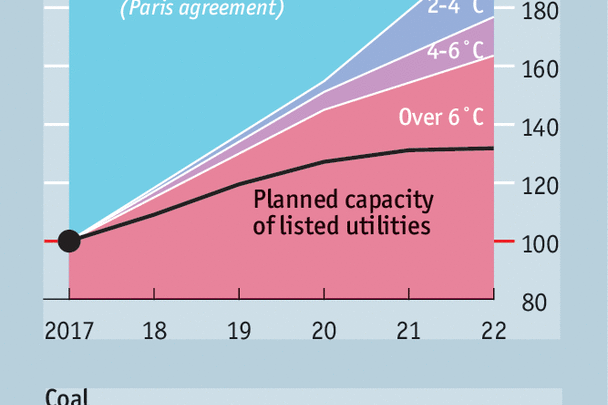

The answer is, not very. In the next five years carbon-intensive firms in the insurers’ portfolios plan to produce more internal combustion engines and coal-fired electricity than the maximum the International Energy Agency (IEA) reckons is compatible with meeting the 2°C goal (see chart). Meanwhile, investment plans in renewable energy and electric vehicles lag behind the IEA’s projections of what is needed.

The results echo those of a study last…Continue reading